Supreme Court just made it easier to sue you for pregnancy discrimination

The Supreme Court just interpreted the Pregnancy Discrimination Act (PDA) differently than some employers currently do. As a result, it’ll open up employers to more lawsuits.

The High Court just ruled that if you treat pregnant employees differently from other individuals with similar work restrictions, you can get sued.

On its face, that sounds pretty reasonable and straight forward — so much so, in fact, that you may be thinking the PDA already spells that out.

Well, here’s what the PDA says:

“women affected by pregnancy, childbirth, or related medical conditions shall be treated the same for all employment-related purposes, including receipt of benefits under fringe benefit programs, as other persons not so affected but similar in their ability or inability to work, and nothing in section 703(h) of this title shall be interpreted to permit otherwise.”

The problem is there’s more than one way to interpret that clause.

Here’s how UPS — the company involved in the high-profile case before the High Court — did:

It said it would only offer alternative work assignments (aka, light duty) to three groups of individuals. They are:

- employees injured on the job

- employees with a permanent disability under the ADA, and

- certain drivers who’d lost their certification from the U.S. Department of Transportation.

So when Peggy Young, a truck driver who was pregnant and was given a lifting restriction, needed an accommodation to continue working, UPS didn’t grant her one on the basis that she was not injured on the job.

UPS claimed it treated her as it would any other employee injured off the job, thus complying with the PDA’s requirement to treat pregnant individuals as it would other similarly situated individuals (i.e., others injured off the job).

And when Young sued claiming UPS illegally failed to accommodate her lifting restriction two courts — a district court and an appellate court — sided with UPS and granted the company summary judgment.

Lawsuit given new life

The Supreme Court then decided to hear Young’s case and, ultimately, ruled that Young’s case should get new life in a lower court.

It said there was evidence to suggest that Young may have been the victim of discriminatory practices in which UPS treated non-pregnant workers more favorably than pregnant workers with similar work abilities/inabilities.

The High Court interpreted the PDA in a very different way than UPS and, most likely, other companies have.

It set aside the issue of whether a worker was injured on the job or not and simply said it is discriminatory to treat pregnant workers differently from other workers who have similar physical limitations.

New standard put in place

The Supreme Court then devised a test to determine whether a pregnancy discrimination lawsuit, like Young’s, should go to trial.

It said an individual could establish a prima facie case of discrimination (the standard a lawsuit must meet for it to proceed to trial) if the person showed:

- she was pregnant

- she requested an accommodation and was denied, and

- the requested accommodation had been granted to non-pregnant employees with similar abilities/inabilities to work.

The court then said if an individual’s case passed this test, the burden would be on the employer to show a legitimate reason beyond cost or convenience for offering the accommodation to non-pregnant employees but not pregnant employees.

If an employer could do that, the ball would once again bounce into the individual’s court, where all the person would have to show for her lawsuit to proceed to trial is that the employer’s policy placed a greater burden on pregnant workers than non-pregnant workers and the employer’s rational didn’t justify creating that burden.

What employers must do now

This ruling changes the game for employer policymaking.

Employers must now be wary of creating any type of policy that accommodates non-pregnant employees and fails to accommodate pregnant workers with similar work restrictions — like the one implemented by UPS.

The Supreme Court has made it clear through this ruling, that denying accommodations to pregnant employees that have been granted to other individuals with similar abilities leaves you wide open to a lawsuit, regardless of other caveats in your policy — like those distinguishing on-the-job injuries from other non-work-related injuries.

Tread carefully.

Cite: Young v. UPS Inc.

For more HR News, please visit: Supreme Court just made it easier to sue you for pregnancy discrimination

Source: News from HR Morning

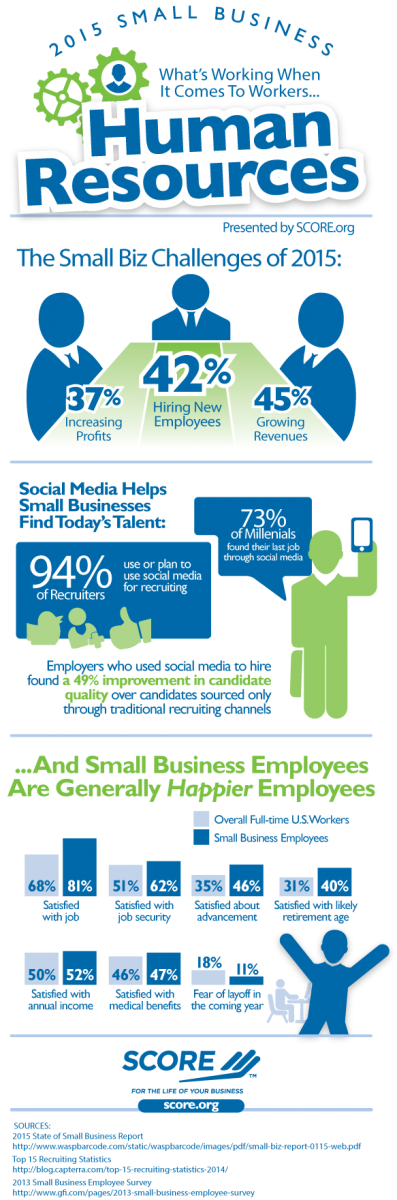

![HR administration: More difficult for small businesses? [Infographic] HR administration: More difficult for small businesses? [Infographic]](https://cyahr.com/wp-content/uploads/2015/03/SCORE-Infographic-HR-20151.png)